Israel's Generative AI expansion: A 2024 market overview

Israel's Generative AI expansion: A 2024 market overview

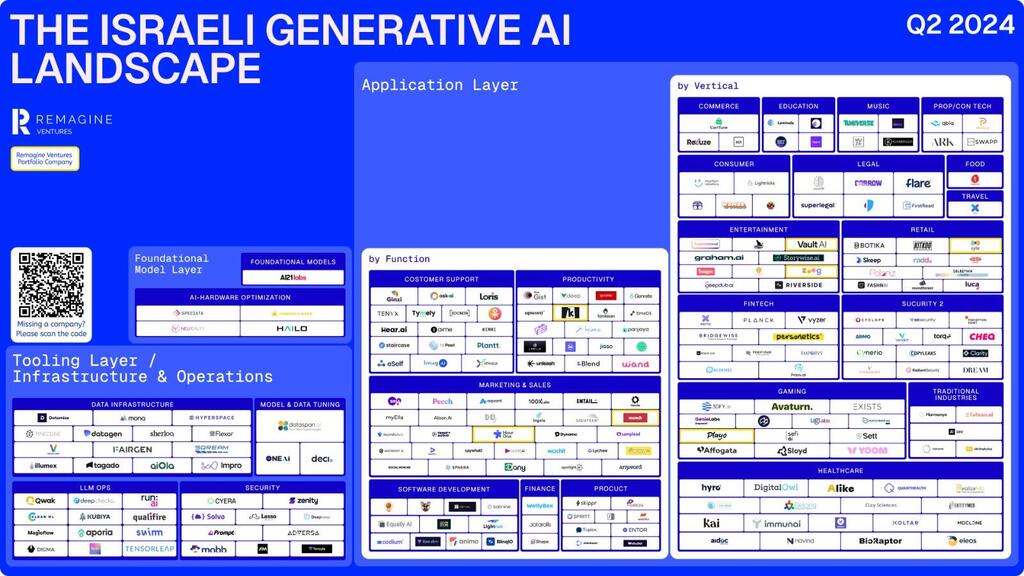

The local GenAI landscape now covers 27 categories, a significant expansion from 17 previously, featuring a total of 238 companies, almost double from last September

The generative AI market is exploding globally, with venture capitalists pouring $12.8 billion into startups in just the first quarter of 2024, according to Pitchbook data. While still in its early days, this transformative technology is seeing rapid adoption by consumers and businesses alike.

Israel is positioning itself as one of the potential leading hubs for generative AI globally. The 2024 AI Index report by Stanford University placed Israel in the top spot for AI talent concentration in a geographic area. Israel’s strengths in AI, machine learning, and data science combined with its culture of innovation and entrepreneurship provide a fertile ground for generative AI startups.

Since we last mapped Israel's generative AI landscape in September 2023 with 144 startups, the number of local companies in this space has nearly doubled. Our updated landscape now covers 27 categories, a significant expansion from 17 previously, featuring a total of 238 companies.

The healthcare category leads in total funding raised at $928.16 million, closely followed by security ($781.34 million), consumer ($422.5 million, boosted by Lightricks' large round), and data infrastructure ($411 million).

In terms of number of companies, marketing & sales is the largest category with 29 startups, trailed by security (23), healthcare and productivity (18 each), and customer support (16).

The biggest funding round went to AI research company AI21 Labs which completed a $208 million Series C, raising $336 million in total to date. Across all Israeli companies, the total funding amassed to date is an impressive $5.47 billion. The figure may well be higher as many funding rounds are not publicized.

Amid the hype, it's prudent to critically examine which companies genuinely qualify as "generative AI." Does simply using OpenAI's API or incorporating GPT language features make a startup a generative AI company?

Defining the boundaries isn't straightforward, but our methodology included only companies where generative AI is the core product offering or a key component, excluding those using the tech for minor features.

Despite the buzz, Enterprises have been slow to adopt Generative AI technology. Concerns about privacy, security, copyright and the issue of model hallucinations are just some of the issues that need to be addressed before we see wider adoption. At the same time, these are potential opportunities for startups to address.

In short, generative AI is undeniably an explosive growth sector in the Israeli tech ecosystem, attracting talent and capital at an extraordinary rate. At Remagine Ventures, we’re actively investing in this space and looking for interesting solutions in the space of AI Agents, Vertical SaaS AI, workflow automation and new applications for creative technologies. As the Generative AI sector matures, we’re confident we’ll see big startup successes coming out of Israel.

Methodology

It is crucial to note that not all the newly added companies were established during the timeframe between our initial landscape and the current one, but rather reflect an enriched understanding of what defines a Generative AI company. Equally, we have removed companies from the landscape where Generative AI is not the core product.

There are several crucial factors to consider in determining whether a company qualifies as a generative AI entity:

- Focus and Core Competency: Evaluate whether generative AI is a central focus of the company's business or just one aspect of their offerings. Companies that are generative AI companies at their core typically prioritize research, development, and innovation in generative AI technologies across multiple products or services.

- Depth of Expertise: Assess the depth of expertise the company has in generative AI. Generative AI companies at their core often have a dedicated team of researchers, engineers, and domain experts who specialize in generative modeling, whereas companies using generative AI for specific features may rely more on external tools or expertise.

- Investment in Research: Investigate whether the company invests significant resources into research and development specifically related to generative AI. Generative AI companies at their core typically have ongoing research initiatives, collaborations with academia, or publications in the field of generative modeling.

- Long-Term Vision: Assess the company's long-term vision and goals. Generative AI companies at their core are likely to have a roadmap for further advancements in generative AI technology and may be positioned for sustained growth in the field, whereas companies using generative AI for specific features may have a more limited scope or horizon.

Eze Vidra and Kevin Baxpehler are Managing Partners of Remagine Ventures and Amit Revivo is an Investment Analyst.